By Laura Sanicola

This article appears differently in the Sep. 28 print issue as additional quotes, graphs and spelling corrections were added online.

In the midst of an ongoing dispute between the Faculty Senate and administration over the legality of the faculty salary imposition, the Faculty Senate sponsored a comprehensive analysis of Fordham’s financial condition directed by Dr. Howard Bunsis. Bunsis, the chair of the Colle ctive Bargaining Congress of the American Association of University Professors and Professor of Accounting at Eastern Michigan University, has audited more than 10 universities and colleges including Rutgers University, San Jose State University and Portland University.

ctive Bargaining Congress of the American Association of University Professors and Professor of Accounting at Eastern Michigan University, has audited more than 10 universities and colleges including Rutgers University, San Jose State University and Portland University.

According to Bunsis, the university holds its own financially.“They’re in solid financial shape and I don’t think [administration] would argue differently,” he told the faculty on a presentation delivered last Friday afternoon to a group of 40 faculty members in the O’Hare Special Collections room of the Walsh Library.

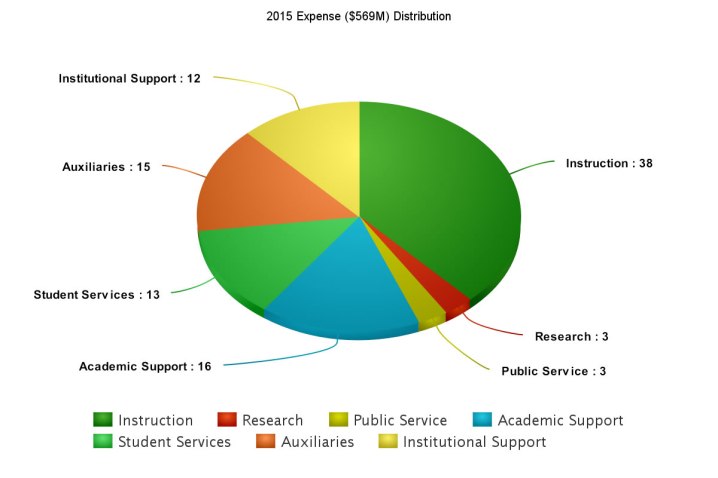

Fordham has the sixth highest bond rating (A2) out of 22 categories, according to a Moody’s report in March 2016. The report cited that Fordham was in a “very good market position as a prominent Jesuit institution” and that it had “consistent growth in net tuition revenue” and “strong fundraising to support capital investment and operations.” The university has $569 million in operating expenses in 2015, according to audited financial statements.

Moody’s cited Fordham’s challenges as “thinning operating margins,” “high leverage” and “heavy dependence on student charge revenue in a competitive market.”

The university has a 55 percent debt ratio index, which Bunsis described as “high.” He attributed the debt ratio to the university’s borrowing to finance a “building boom.” From 2008-2015, the university spent $550.6 million on capital assets and buildings, according to audited financial statements. The university has also shifted much of its portfolio into the riskiest securities, including nonpublic equity funds, hedge funds and private equity funds. By 2015, 2/3 of the university’s portfolio was in the riskiest securities, according to Bunsis’ analysis of Fordham’s audited financial statements. In the same time period, Fordham’s portfolio under performed the S&P 500 by 2.5 percent.

Revenue Sources

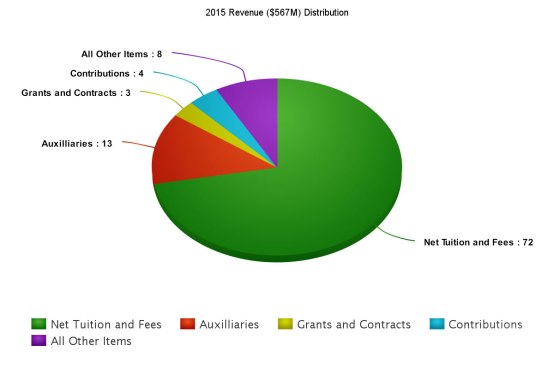

Acco rding to Bunsis, student tuition increase continuations to be the largest revenue generator and has remained at an average of 72 percent of total revenue for the last 6 years. Auxiliaries, such as housing, dining, bookstore, student union, parking, athletics, account for 13 percent of the revenue. The remaining 15 percent of revenue comes from investment income, grants and contracts, contributions and gifts.

rding to Bunsis, student tuition increase continuations to be the largest revenue generator and has remained at an average of 72 percent of total revenue for the last 6 years. Auxiliaries, such as housing, dining, bookstore, student union, parking, athletics, account for 13 percent of the revenue. The remaining 15 percent of revenue comes from investment income, grants and contracts, contributions and gifts.

Spending

In 2015, Fordham spent 38 percent of its expenses on instruction, which includes the salaries of those who teach classes. Institutional support, which includes upper level administration, received 12 percent of the budget. Auxiliaries received 15 percent, and student support, including admissions and student organizations, received 13 percent. Academic support, including deans salaries, library services and advising, received 13 percent. Public service and research received 3 percent of the revenue each.

Faculty Concern

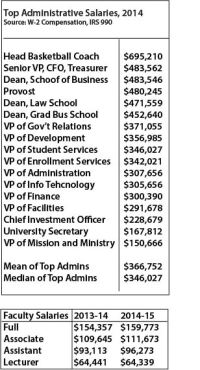

While the percent of instructional salaries and benefits of the total salaries for Fordham employees has decreased from 54.1 percent in 2008 to 51.8 percent in 2015 — a difference of 2.3 percent, institutional support salaries as a percent of total Fordham salaries increased from 12.2 percent to 13.7 percent during that same time period – a difference of 1.6 percent, according to data from The Integrated Postsecondary Education Data System (IPEDS) is a system of interrelated surveys conducted annually by the National Center for Education Statistics (NCES).

The Faculty Senate proposed a 2.7 percent increase in their salaries for the 2016-2017 academic year in May, but received a 2.1 percent increase in August.

The faculty also took issue with the composition of the president’s leadership team, which includes 12 upper level administrators and vice presidents. They contend that only one administrator — the provost — represents the voice of the faculty.

Administrative Response

Bob Howe, vice president of communications, said he has not yet reviewed Bunsis’ analysis but provided the following statement.

“More than 90 percent of Fordham’s operating budget derives from tuition and other student funds (to put Fordham’s finances in perspective, our endowment is only 4.5 percent of the average Ivy League endowment). Among the many other demands upon the operating budget are three that the student press has recently written or inquired about: full-time faculty salaries, adjunct faculty pay, and tuition increases. It’s fairly obvious that those three issues are interrelated. The University’s task is to find a balance among those three items, as well as all the other demands on the University.”