Fordham Remains Indirectly Invested In Fossil Fuels

An advocate for Fossil Free, pictured above, advocates for the divestment of Fordham's endowment from fossil fuels (Photo Courtesy of Facebook).

January 31, 2018

By Jake Shore

While New York City took steps earlier this month to divest the city’s $5 billion pension from fossil fuel companies, some of Fordham University’s endowment fund still remains indirectly invested in fossil fuel producing companies.

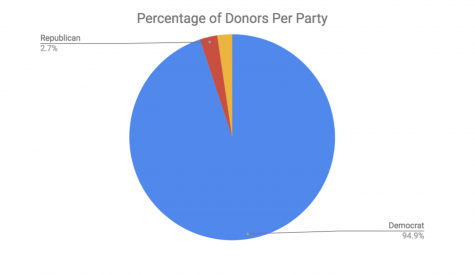

Fordham’s endowment, an investment fund of approximately $750 million made up of gifts from donors to the university, has no direct holdings in fossil fuel companies, according to Chief Investment Officer Eric Wood. Wood, who manages the fund alongside a number of other board members, said Fordham’s indirect involvement with fossil fuels, however, makes up “no more than five percent” of the total fund.

Fordham’s indirect investments in fossil fuels come from its involvements in “commingled pools” where the university’s endowment money is part of a shared fund with other institutions, according to Wood. He said that while it is easy for an institution to announce an end to direct investments to fossil fuels, a full and actual divestment is much more costly because of those pools.

“I could say that today, ‘We are divesting from all, we will not invest in any [coal, fossil fuels] from our direct investments . . . it’s a bit of a PR game that a lot of people are playing,” said Wood.

Divestment is the practice of decreasing or selling off assets in a certain area. The decision to decrease holdings of a type of asset may be made for a variety of reasons, including ethical, political and financial reasons.

The movement among universities to divest from fossil fuels began in 2011 with Swarthmore College. It has since spread to institutions like the University of California system, the University of Massachusetts, the University of Maryland and others, causing them to pledge some form of endowment divestment. Even private universities like Georgetown and Syracuse have announced narrower divestments in the last three years.

Formed in 2015, Fossil Free Fordham is a group that has been pushing for the university to completely divest its endowment money, direct holdings and commingled funds from oil, gas and coal companies. Sarah Morrison, FCRH ’19, runs Fordham’s chapter of the Fossil Free campaign, which was organized through the Sustainability Committee of United Student Government (USG). The campaign has 194 signatures on an online petition to Rev. Joseph M. McShane, S.J., president of the university.

“We need to find a way to bring us towards a more sustainable future. More than anything, I think I want to be able to take pride in the university I attend, and I would be overcome with joy if we could be one of the leaders by divesting from fossil fuels,” said Morrison.

Morrison said the campaign aims to first have Fordham divest from coal companies, one of the “weakest” fossil fuel sources. As an industry, coal has been struggling because of new renewable sources of energy and a dwindling amount of coal worldwide. But even if coal is a slam-dunk for universities looking to divest, scholarship suggests it is not likely that most universities will divest or believe in the benefits of doing so.

In a study on the financial impacts of university divestments from fossil fuel companies, professor Hendrik Bessembinder of Arizona State University found that while university administrators usually sympathize with students pushing for divestment, the costly nature of divesting outweighs the potential benefits.

“Even if only a small portion of a [university endowment’s] assets are invested in fossil fuel companies, the entire fund must be sold (and some new set of assets purchased to replace it) in order to divest. This can dramatically increase the share of a university’s portfolio that has to be turned over to fulfill a fossil fuel divestment pledge,” wrote Bessembinder.

Eric Wood touted Fordham’s “positive-impact” investments from its endowment. As mandated by the mission statement of the endowment, five percent of the total $750 million is required to go towards projects and companies with a positive impact. Wood said this year Fordham is considering investing in a firm that operates in wind and solar power in Europe.

However, Morrison is skeptical that remaining invested in fossil fuels meshes with the Jesuit mission of the university.

“There is no way that five percent of our endowment going towards positive things offsets the negative consequences of investing in fossil fuels, which are companies that are directly accelerating climate change and impacting impoverished communities across the United States,” said Morrison.

Wood said Fordham will be conducting a review this year on its indirect holdings in fossil fuel companies.

If you want a picture to show with your comment, go get a gravatar.